Introduction

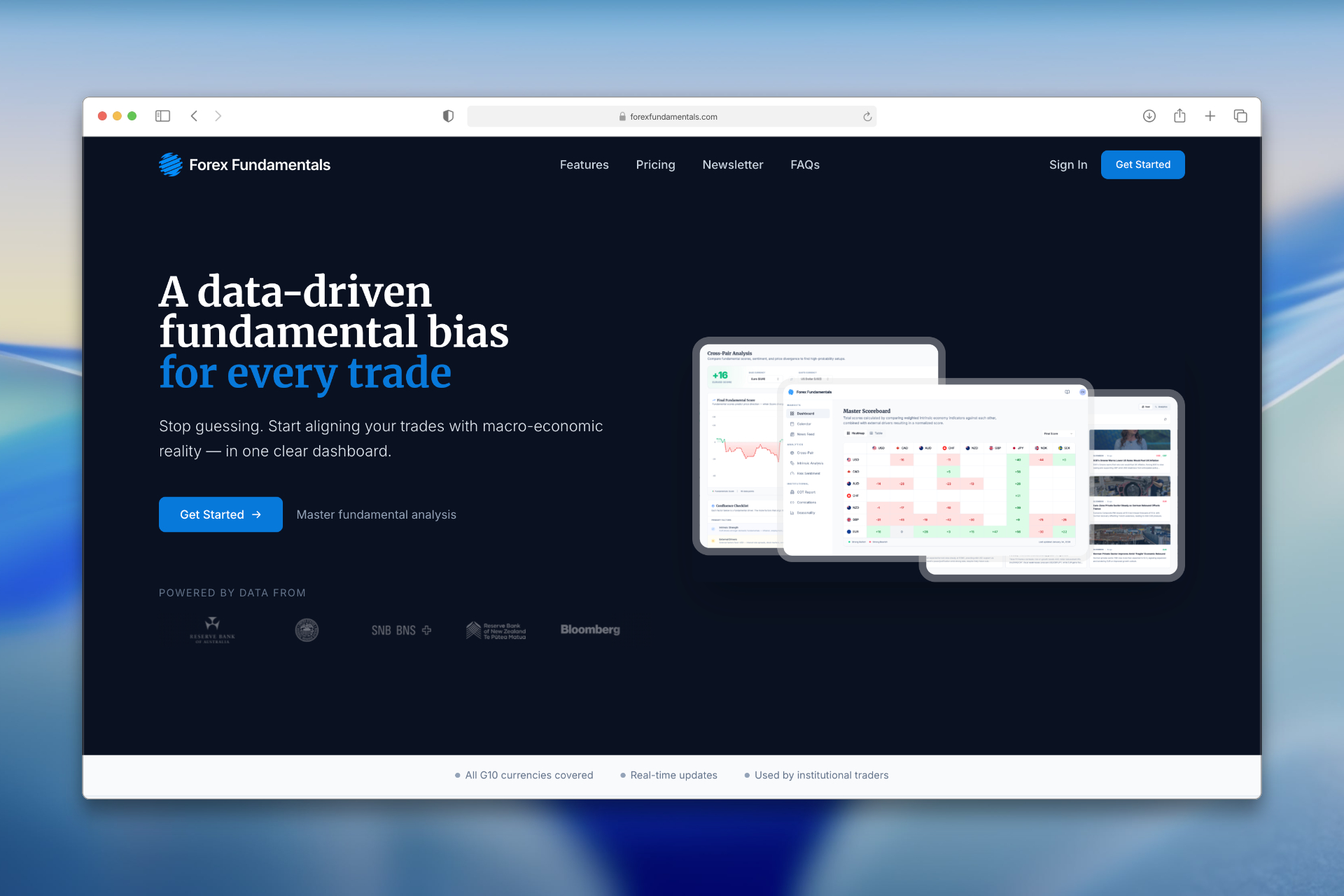

Welcome to the Forex Fundamentals documentation — a macroeconomic analysis platform that helps forex traders identify high-probability opportunities based on fundamental currency strength.

Our Approach: Use fundamental analysis to find directional potential, then wait for price action to confirm your entry.

Key Principles

| Principle | Description |

|---|---|

| Multi-Layered Analysis | Combine economic fundamentals, market dynamics, sentiment, and institutional positioning |

| Trend vs. Timing | Fundamentals identify potential trends (weeks to months), but price action confirms timing |

| Confluence Over Conviction | The strongest setups occur when multiple factors align |

Recommended Workflow

- Market Sentiment — Risk-On/Risk-Off environment

- Currency Scoreboard — Pairs with strong fundamental signals

- Intrinsic Analysis — Individual currency strength

- Cross-Pair Analysis — Detailed pair dynamics

- COT Positioning — Institutional alignment

- News Sentiment — Real-time news support

- Economic Calendar — Upcoming high-impact events

- Price Action — Technical entry confirmation

Confluence Checklist

A strong setup includes:

- ✅ Strong Cross-Pair Score on Scoreboard

- ✅ Intrinsic strength/weakness confirmed

- ✅ Market Sentiment aligns

- ✅ Positive swap rate

- ✅ Supportive News Sentiment

- ✅ COT confirms institutional positioning

- ✅ No imminent high-impact events

- ✅ Price action confirms entry

Getting Started

Start with the Currency Scoreboard for current opportunities, then explore the tools that interest you most.

Remember: Fundamentals identify trends, but we cannot predict exact timing. Always wait for price action confirmation.