Economic Calendar

The Economic Calendar provides a comprehensive view of upcoming macroeconomic events and data releases that can impact currency markets. This tool helps you anticipate potential market-moving events and plan your trading strategy accordingly.

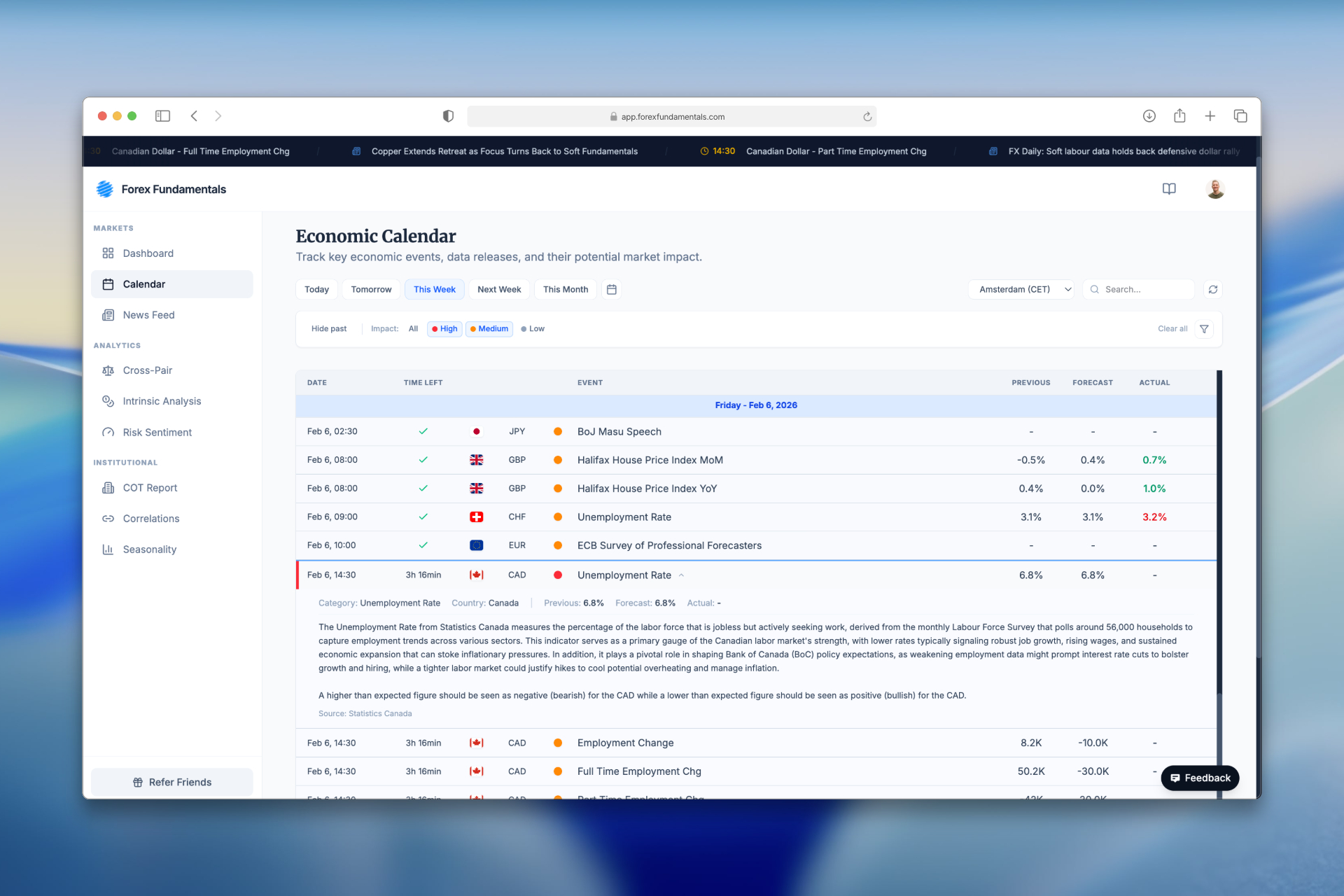

The calendar displays scheduled economic events with their impact level (HIGH, MED, LOW), the affected currency, expected values, previous values, and actual results once released.

Overview

Economic data releases are among the most significant drivers of short-term currency volatility. The Economic Calendar consolidates scheduled announcements from major economies, allowing you to:

- Anticipate Volatility - Know when major data releases might create price swings

- Plan Entries and Exits - Time your trades around key events

- Validate Fundamental Analysis - See if upcoming data aligns with your Intrinsic Analysis thesis

- Manage Risk - Avoid or prepare for high-impact news events

Key Economic Indicators

High-Impact Events

These events typically cause the most significant market movements:

- Central Bank Decisions - Interest rate announcements and policy statements

- Employment Data - Non-farm payrolls, unemployment rates, job creation figures

- Inflation Reports - CPI, PPI, and PCE data

- GDP Releases - Quarterly economic growth figures

- Retail Sales - Consumer spending indicators

- Manufacturing & Services PMI - Economic activity surveys

Medium-Impact Events

These can create moderate volatility, especially if results deviate from expectations:

- Trade Balance - Export/import data relevant to Balance of Payments

- Consumer Confidence - Sentiment indicators

- Housing Data - Building permits, home sales, housing starts

- Industrial Production - Manufacturing output

Low-Impact Events

Regular releases that typically create minimal market reaction unless significantly unexpected:

- Weekly jobless claims

- Business inventories

- Various sub-indices and regional surveys

Using the Economic Calendar

Strategic Workflow

- Review Upcoming Events - Check the calendar at the start of each week and day

- Identify High-Impact Events - Focus on central bank decisions and tier-1 data releases

- Cross-Reference with Analysis - Compare expected data with your Currency Scoreboard bias

- Plan Around Volatility - Decide whether to trade the event, avoid it, or wait for post-event clarity

- Monitor Real-Time Sentiment - Use News Sentiment during and after releases

Trading Considerations

- Before the Event - Markets often price in expectations; consider whether your position aligns with consensus

- During the Event - Spreads widen and slippage increases; be cautious with market orders

- After the Event - Initial reactions can be misleading; wait for the market to digest the information

Integrating with Other Tools

The Economic Calendar works best when combined with:

- Currency Scoreboard - See if economic data aligns with fundamental bias

- Intrinsic Analysis - Understand how data feeds into overall currency strength

- News Sentiment - Real-time reaction and interpretation of data releases

- Market Sentiment - Context of overall market risk appetite

- COT Positioning - See how institutional traders are positioned ahead of events