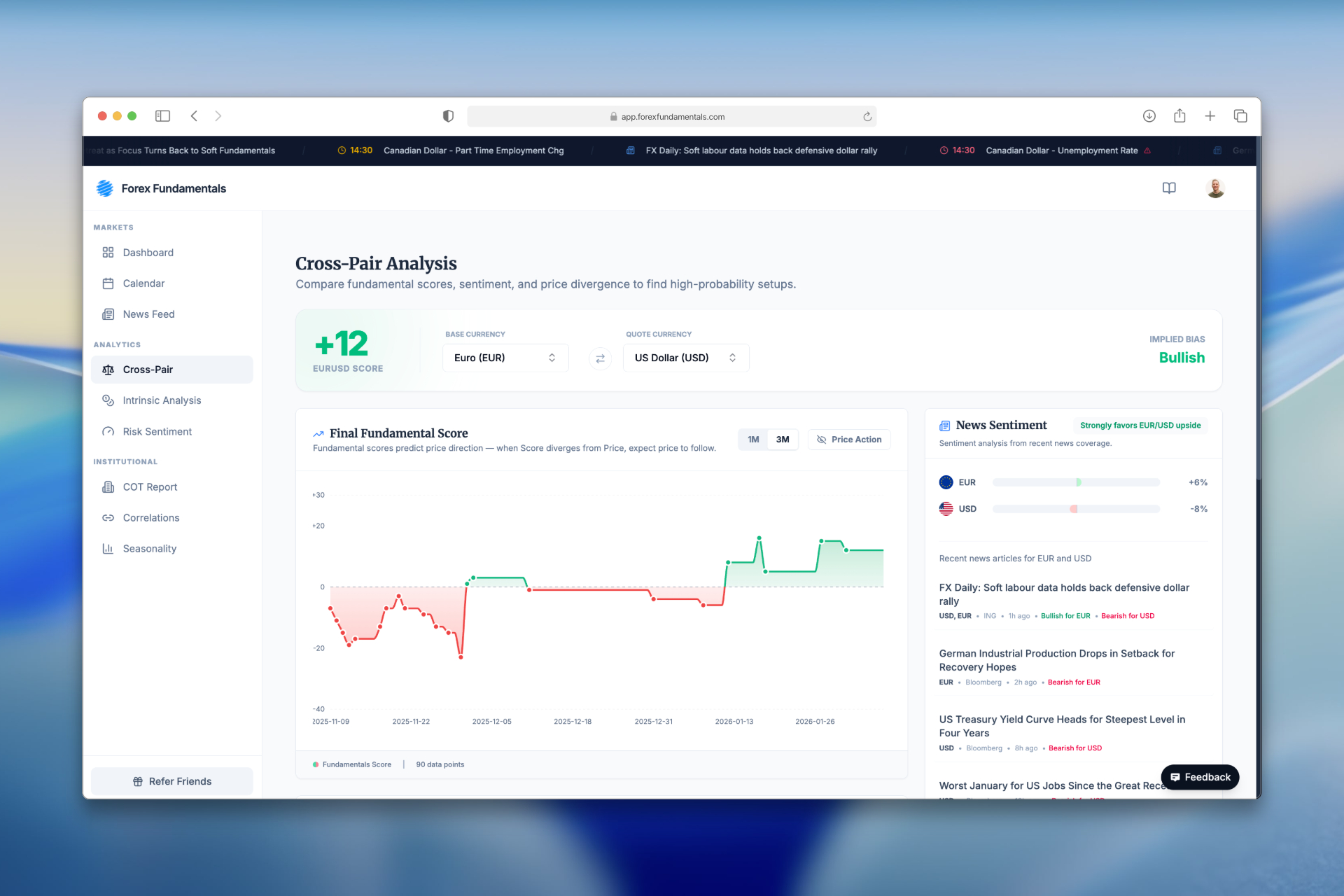

Cross-Pair Analysis

The Cross-Pair Analysis provides in-depth analysis of individual currency pairs, combining comprehensive fundamental data with real-time market intelligence. When you select a specific pair from the Currency Scoreboard, you get access to detailed analysis that helps you make informed trading decisions.

Analyzing a currency pair

When you select a specific currency pair, you can see:

- The two Intrinsic Values - The individual fundamental scores for each currency in the pair

- The weighted Cross-Pair Score - The combined score that shows the overall directional bias for the currency pair

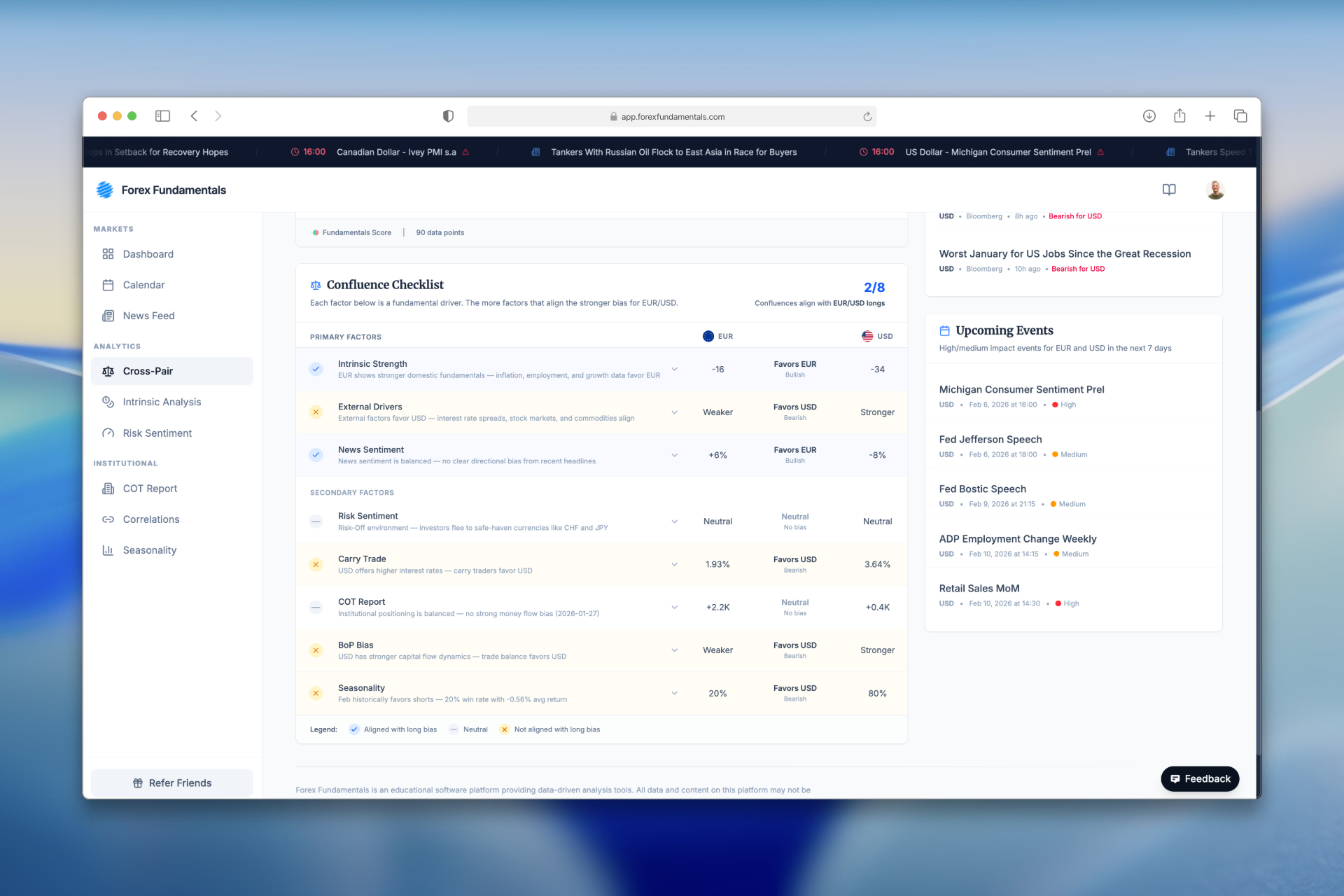

Confluence Checklist

The Confluence Checklist provides a comprehensive overview of all factors that influence the directional bias for a currency pair. Each factor is evaluated and marked as aligned, neutral, or not aligned with the suggested trade direction.

Primary Factors:

- Intrinsic Strength — Compares the domestic fundamentals (inflation, employment, growth data) of both currencies

- External Drivers — Evaluates interest rate spreads, stock markets, and commodity correlations

- News Sentiment — Assesses recent headlines and their directional bias for the pair

- Risk Sentiment — Current Risk-On/Risk-Off environment (primary for pairs with strong risk currencies like AUD, NZD, JPY, CHF; secondary for other pairs)

Secondary Factors:

- Carry Trade — Interest rate differentials that attract carry traders

- COT Report — Institutional positioning and money flow bias

- BoP Bias — Balance of Payments and capital flow dynamics

- Seasonality — Historical performance patterns for the current month

The checklist shows how many factors align with the suggested bias (e.g., "2/8 Confluences align with EUR/USD longs"), helping you quickly assess the strength of the trade setup.

Data behind the Crosspair Score

The Cross-Pair Analysis Score is the final, synthesized output of the entire analytical process. It is an advanced score designed to quantify the complete relationship between two currencies.

A Weighted Comparison of Intrinsic Scores & External Drivers

The Cross-Pair Score consists of two key components:

-

Weighted Intrinsic Comparison - The Intrinsic Value (see Intrinsic Analysis) of each currency represents its fundamental, domestic economic health. To analyze a pair, the model compares these weighted intrinsic economy indicators against each other, determining which currency has the stronger fundamental position.

-

External Drivers - Beyond intrinsic fundamentals, external factors influence the relationship between currencies. These include yield differentials, terms of trade dynamics, and relative economic performance metrics that act on the pair as a whole.

How the Score is Calculated

The total Cross-Pair Score is calculated by comparing the weighted intrinsic economy indicators of both currencies against each other, then combining this with the external drivers. The result is a normalized score that represents the overall directional bias for the currency pair.

When both the intrinsic comparison and external drivers align in the same direction, the Cross-Pair Score will be stronger, signaling high confidence in the trading direction. When they diverge, the score reflects this uncertainty with a more moderate value.

Important: Trend vs. Timing

This score identifies a potential trend based on deep macroeconomic analysis. This underlying trend can last from several weeks to even months.

However, what the score cannot predict is the timing. It may take days or weeks for the market to fully reflect this direction, or in some cases, the trend may have already been absorbed by the price.

The most effective approach, therefore, is to use the Cross-Pair Analysis Score as a strategic guide and wait for price action itself to present a clear signal that aligns with the expected trend.

Integrating Other Tools

For a complete trading picture, combine Cross-Pair Analysis with:

- Currency Scoreboard - Overview of all pairs with heatmap and detailed metrics table

- Intrinsic Analysis - Understand the fundamental drivers of each individual currency

- Market Sentiment - Context of overall Risk-On/Risk-Off market dynamics

- News Sentiment - Real-time news and sentiment analysis

- COT Positioning - Institutional positioning for confirmation or contrarian signals