Market Sentiment

The Market Sentiment indicator measures the overall risk appetite in forex markets, helping you understand whether traders are seeking risk (Risk-On) or fleeing to safety (Risk-Off). This indicator is designed to measure medium-to-long-term market sentiment based exclusively on components from the Forex market.

It analyzes the price performance of specific currency futures contracts to gauge the underlying market appetite for risk. This information is crucial when selecting pairs in Cross-Pair Analysis, as you want to align your trades with the dominant sentiment.

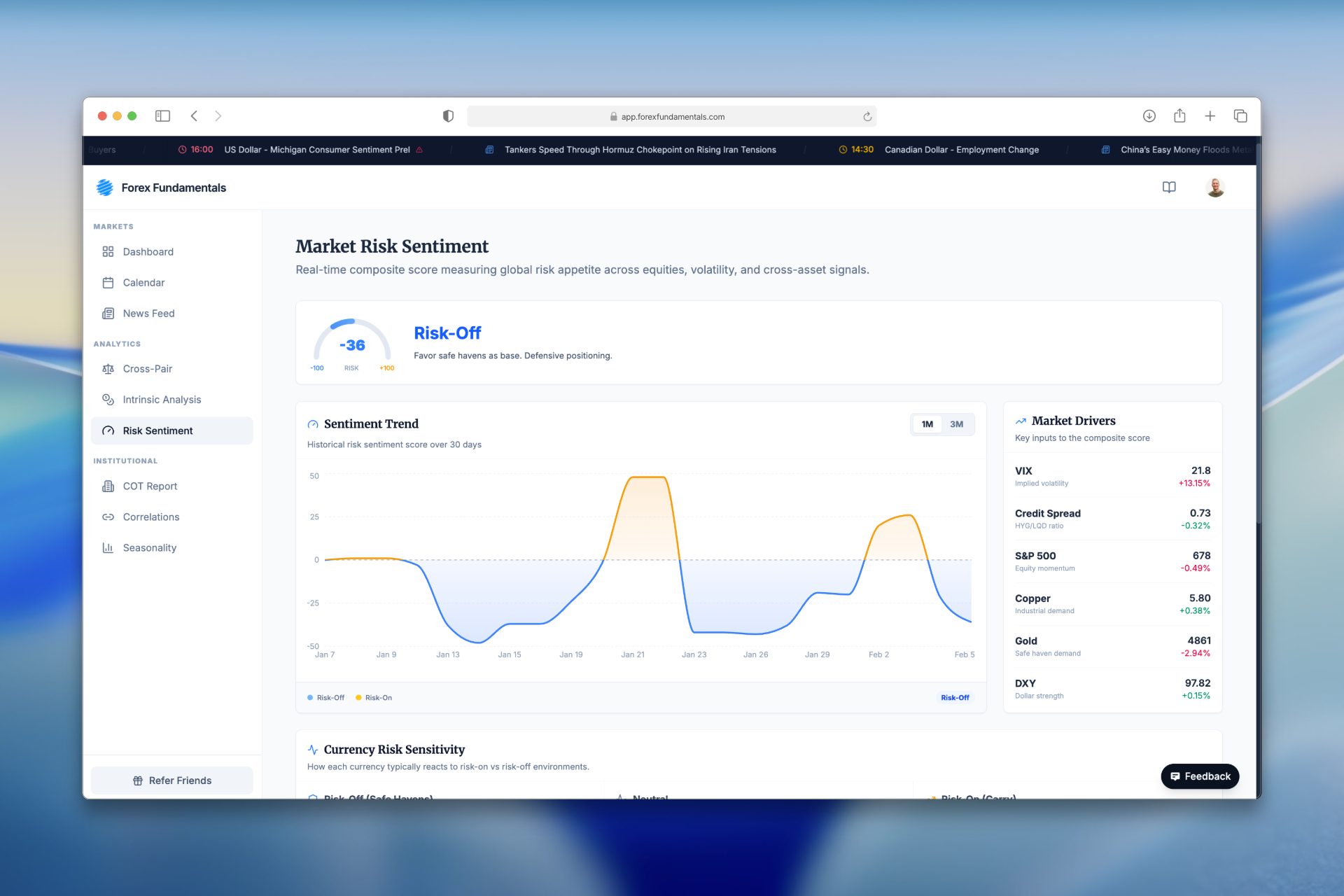

The sentiment dashboard displays the overall Risk-On/Risk-Off score along with its historical trend, key market drivers, and currency risk sensitivity classifications. This gives you a complete picture of current market mood.

Methodology

The indicator's score is derived from the price performance of classified Risk-On and Risk-Off currencies, combined with cross-asset market drivers.

-

Market Drivers:

- The score incorporates key market inputs including VIX (implied volatility), Credit Spreads, S&P 500 performance, Copper (industrial demand), Gold (safe haven demand), and DXY (dollar strength).

-

Calculation:

- These inputs are weighted and combined to produce a single, normalized risk sentiment score that reflects the current market appetite for risk.

-

Supplementary Input:

- It is crucial to also consider News Sentiment. News events can signal rapid shifts in sentiment before they are fully reflected in market data.

Currency Classification

The indicator focuses only on currencies with historically clear risk correlations. Other currencies are excluded as their behavior can be agnostic or antagonistic to sentiment, making them unreliable static proxies.

Risk-On Currencies

These currencies tend to rise during periods of positive sentiment (Risk-On) and fall during uncertainty.

- AUD (Australian Dollar)

- NZD (New Zealand Dollar)

- CAD (Canadian Dollar)

- NOK (Norwegian Krone)

Risk-Off Currencies

These currencies tend to rise during periods of negative sentiment (Risk-Off) as capital flows to safety.

- JPY (Japanese Yen)

- CHF (Swiss Franc)

Neutral / Excluded Currencies

- USD: Neutral. Has recently shifted from its traditional Risk-Off role.

- EUR: Neutral, with a very slight Risk-Off tendency.

- GBP: Neutral, with a Risk-On tendency relative to the EUR.

- SEK: Neutral, but tends toward Risk-On as it's a minor currency carrying greater risks in times of uncertainty.

Trading Applications

The indicator helps traders align their positions with the dominant market sentiment. The primary strategy is to pair a "strong" currency (backed by sentiment) against a "weak" currency (contradicted by sentiment).

Example Scenarios:

Scenario 1: Risk-Off Sentiment

- Indicator Reading: The sentiment score is negative (e.g., -28).

- Market Mood: Fearful, uncertain.

- Strategy: Favor (buy) Risk-Off currencies (JPY, CHF) and sell Risk-On currencies (AUD, NZD, CAD, NOK).

- Potential Pairs:

- SHORT AUD/JPY (Selling Risk-On AUD / Buying Risk-Off JPY)

- SHORT AUD/CHF

- SHORT NZD/JPY

- SHORT CAD/CHF

Scenario 2: Risk-On Sentiment

- Indicator Reading: The sentiment score is positive (e.g., +33).

- Market Mood: Optimistic, risk-seeking.

- Strategy: Favor (buy) Risk-On currencies (AUD, NZD, CAD, NOK) and sell Risk-Off currencies (JPY, CHF).

- Potential Pairs:

- LONG AUD/JPY (Buying Risk-On AUD / Selling Risk-Off JPY)

- LONG NZD/CHF

- LONG CAD/JPY

- LONG AUD/CHF

Integration with Other Tools

Market Sentiment works best when combined with other analytical tools:

- Use Cross-Pair Analysis to find specific pairs that align with the current sentiment regime

- Check Intrinsic Analysis to ensure individual currency fundamentals support your sentiment-based trade

- Monitor News Sentiment for potential sentiment shifts before they appear in futures data

- Review COT Positioning to see if institutional traders are aligned with or against current sentiment