Currency Scoreboard

The Currency Scoreboard is the pinnacle of our analytical framework, providing an at-a-glance view of all major currency pairs through a comprehensive heatmap and detailed metrics table. This dashboard synthesizes the Intrinsic Analysis of individual currencies with comparative market dynamics to identify optimal trading opportunities.

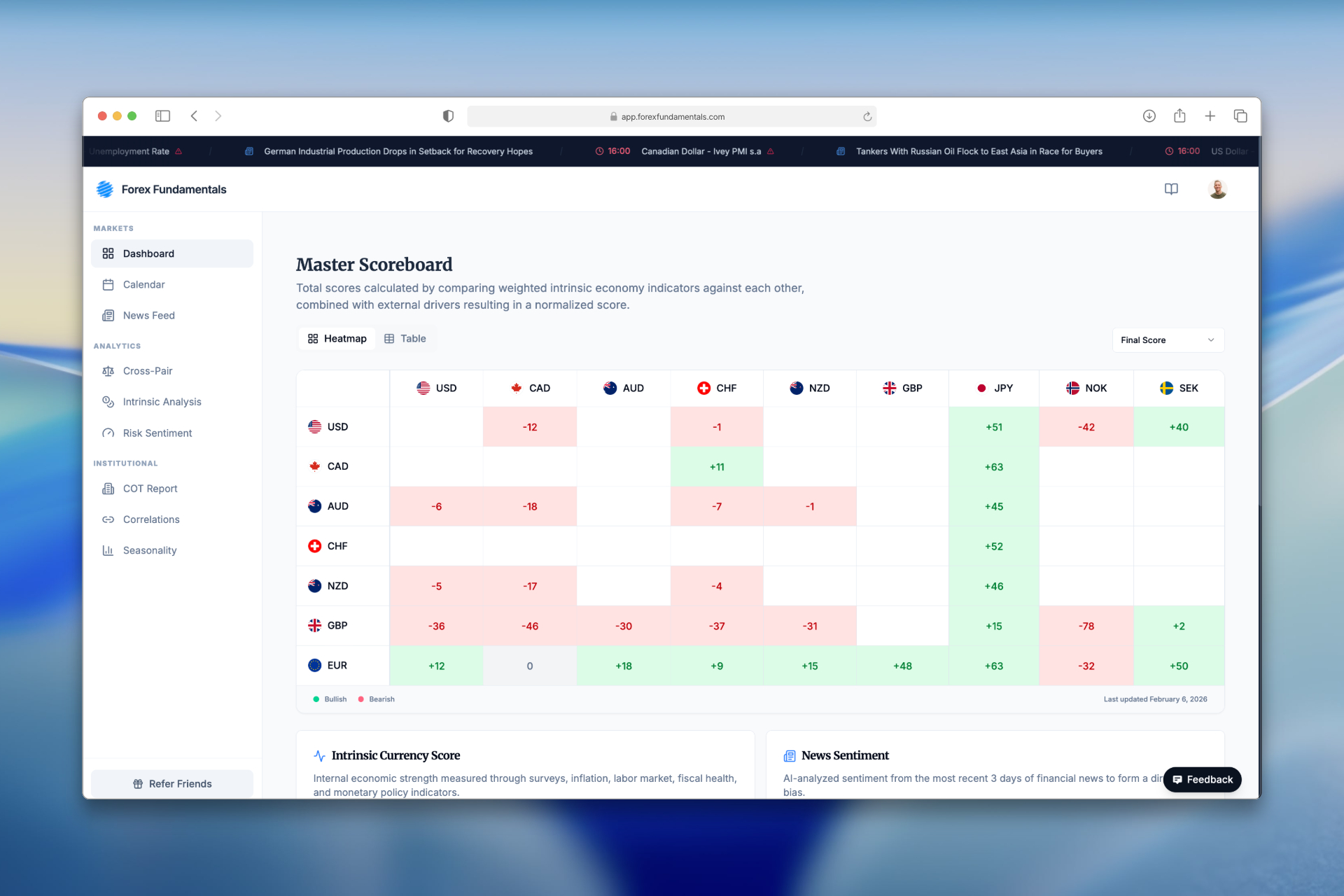

Currency Scoreboard - Heatmap

The heatmap provides an complete overview of all major currency pairs, color-coded by their Cross-Pair Analysis Score. Green indicates bullish opportunities, red indicates bearish opportunities, and the intensity shows the strength of conviction.

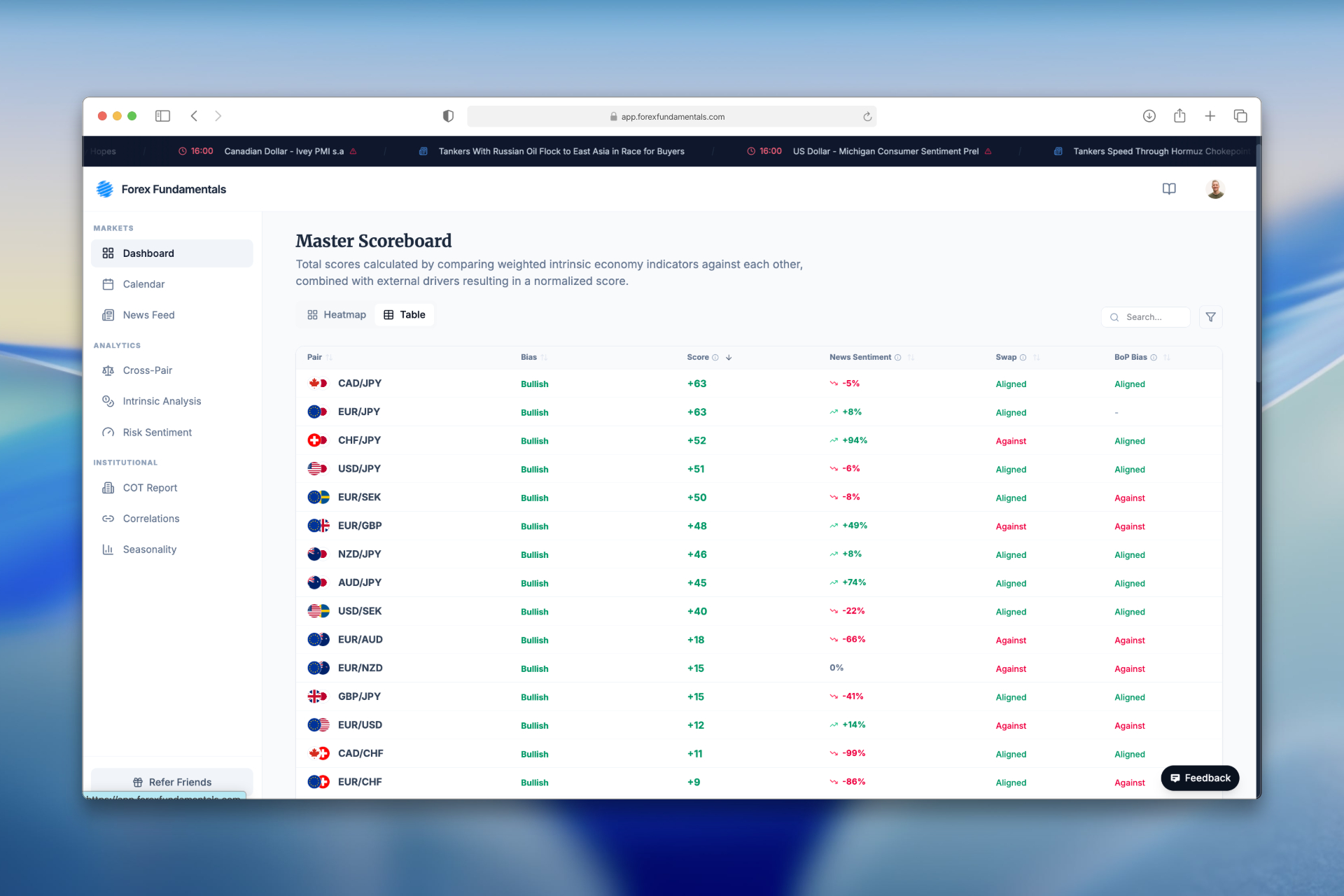

Currency Scoreboard - Table

The detailed table displays key metrics for each pair including the Cross-Pair Score, Balance of Payments indicator, Swap rates, and directional signals.

Important: Trend vs. Timing

The scores identify potential trends based on deep macroeconomic analysis. These underlying trends can last from several weeks to even months. However, what the scores cannot predict is the timing. It may take days or weeks for the market to fully reflect this direction, or in some cases, the trend may have already been absorbed by the price.

The most effective approach is to use the Currency Scoreboard as a strategic guide and wait for price action itself to present a clear signal that aligns with the expected trend.

The Balance of Payments (BOP)

As an additional layer of fundamental confluence, our analysis also incorporates the Balance of Payments (BOP).

According to the balance of payments equilibrium theory, these data provide a directional bias by revealing whether a country is running a consistent surplus (inflows) or a persistent deficit (outflows).

- Bullish Signal: A consistent BOP surplus—driven by strong exports or capital inflows—suggests the currency is likely to strengthen.

- Bearish Signal: A persistent or widening BOP deficit—from heavy imports or capital outflows—indicates potential weakness.

It is critical to note that this is a qualitative overlay, not a quantitative score. This BOP analysis provides a clear bullish or bearish indication, refining our Long/Short biases and offering traders an additional layer of actionable, directional confirmation.

Swap

The Swap column shows the theoretical "rollover" or "carry" based on interest rate (IR) differentials, indicating the expected credit or cost for holding a position overnight. This score is always interpreted from a Long perspective: positive means you theoretically earn a credit, while negative means you incur a cost (the opposite applies to Short positions). It is crucial to remember this is theoretical, as brokers often add extra fees that make the real swap rate less favorable; you may even be charged on positions that should theoretically pay you. Therefore, while a positive Swap score on a Long trade is a good sign, always check your broker's specific rates.

News Sentiment

While the score is built on deep macroeconomic data, markets can be suddenly disrupted by real-time events. An unexpected news item, such as a tariff announcement or a shift in geopolitical stability, can create immediate volatility that temporarily overrides the underlying trend.

Therefore, especially when considering shorter-term trades, it is highly advisable to use News Sentiment as an additional layer of confluence. This helps confirm that the immediate market mood does not strongly contradict the model's deeper, fundamental bias.

Using the Currency Scoreboard

- Start Broad - Begin with the heatmap to identify pairs with strong signals

- Review Metrics - Use the detailed table to compare key indicators across pairs

- Assess Confluence - Look for alignment between Intrinsic Values, BOP, Swap rates, and sentiment

- Drill Down - Click on specific pairs for detailed Cross-Pair Analysis

- Wait for Price Action - Use the fundamentals as a directional bias while waiting for technical confirmation

Integrating Other Tools

For a complete trading picture, combine the Currency Scoreboard with:

- Cross-Pair Analysis - Detailed analysis of individual currency pairs

- Intrinsic Analysis - Understand the fundamental drivers of each individual currency

- Market Sentiment - Align your pair selection with overall Risk-On/Risk-Off dynamics

- News Sentiment - Stay informed about breaking developments

- COT Positioning - Understand institutional trader positioning for potential trend confirmation or contrarian signals