Intrinsic Analysis

The Intrinsic Analysis examines the core drivers within a specific economy to determine a currency's fundamental strength. This analysis produces one comprehensive score per currency that synthesizes all underlying macroeconomic factors into a single, actionable metric.

Unlike Cross-Pair Analysis, which compares two currencies directly, this method focuses on the individual health of each currency based on domestic economic factors.

This analysis reveals the intricate dynamics of domestic economic factors that shape a currency's value over time. By concentrating on internally-generated factors, we can trace the ripple effects of domestic policies and decisions across various sectors.

For instance, a shift in domestic interest rates influences consumer spending. This change subsequently affects business investments, employment rates, and ultimately, inflation. These interconnected relationships form the foundation of our intrinsic strength analysis, offering a holistic view of an economy's health and trajectory.

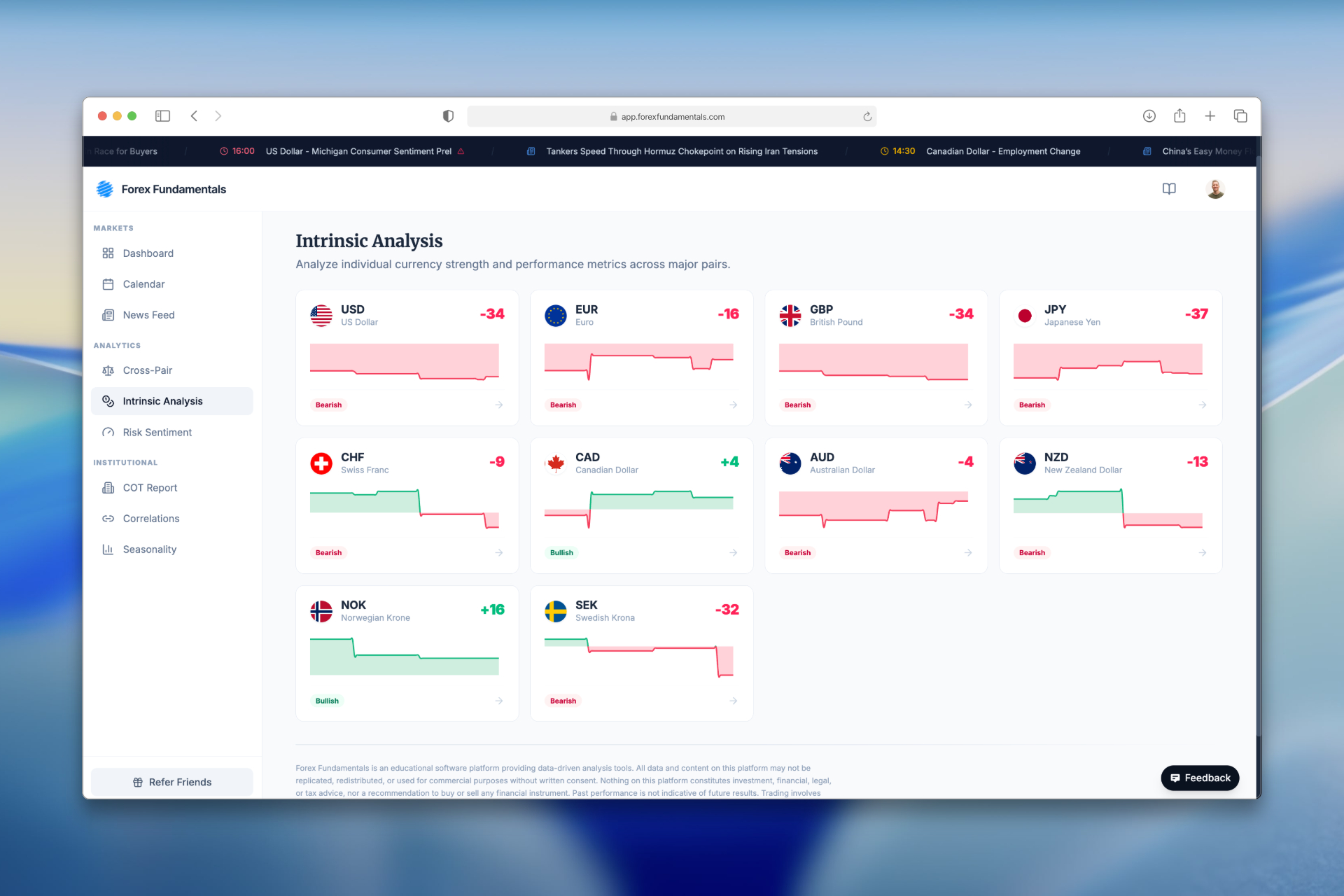

Currency Scoreboard

The main dashboard displays all major currencies with their respective intrinsic strength scores, allowing you to quickly identify which currencies are showing fundamental strength or weakness.

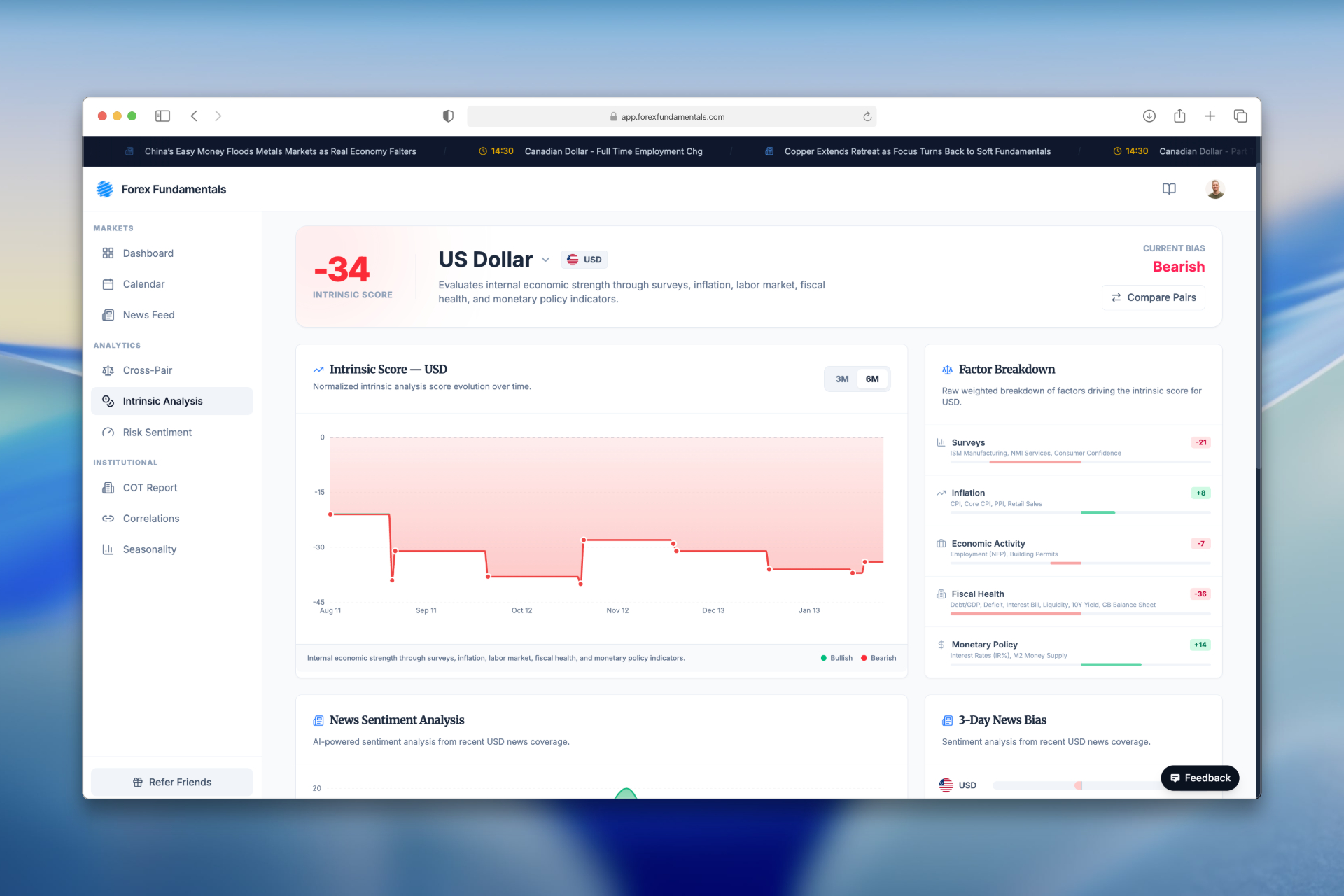

Detailed Currency Analysis

Clicking on any currency provides detailed insights including historical score trends, contributing economic factors, and sentiment indicators. The news sentiment integration (see News Sentiment) helps you understand recent developments affecting the currency.

The Essence of Intrinsic Analysis

The value of this analysis lies in its ability to unveil the fundamental mechanisms driving an economy. While Cross-Pair Analysis examines external shocks and global events, intrinsic strength score focuses on the core drivers within a specific economy.

The Scoring Model and Economic Outcomes

Central to our model is a scoring system that aggregates multiple macroeconomic factors—such as interest rates, inflation, GDP growth, employment data, and trade balances—into a single intrinsic strength score for each currency. This scoring is driven by a statistical evaluation of these factors and their historically-observed impact on the currency. The resulting score functions as a key indicator of a currency's potential direction.

- Negative scores indicate deflationary pressure. In such scenarios, the currency's purchasing power typically strengthens. While a strong currency may seem beneficial, persistent deflation often signals an economic slowdown, leading to decreased spending and investment.

- Positive scores suggest inflationary trends. While moderate inflation is a component of a healthy economy, high positive scores indicate a decline in purchasing power, potentially eroding savings and fostering instability.

- A neutral score symbolizes a balance where inflationary and deflationary forces are in equilibrium.

Forecasting Central Bank Policy

A significant advantage of this system is its ability to anticipate potential monetary policy actions. Central banks closely monitor these pressures, adjusting policy to ensure economic stability.

When our model registers negative scores (deflationary pressure), central banks are more likely to implement expansionary policies. This could involve lowering interest rates or increasing the money supply to counteract the deflationary trend and stimulate economic activity.

Conversely, high positive scores (inflationary pressure) may prompt contractionary policies. In these situations, central banks might raise interest rates—making borrowing more expensive and encouraging saving—or decrease the money supply to cool off an overheating economy.

The Strategic Value: Anticipating Second-Order Effects

Understanding these potential policy reactions is the crucial advantage. It allows an analyst to see beyond the immediate 'first-order' reaction to an economic report (e.g., a brief panic-sell on high inflation data).

Instead, the analyst can forecast the 'second-order' effect: the actual policy adjustment the central bank will likely make in response (e.g., raising interest rates to fight that inflation). This anticipated policy shift often drives a much larger and more durable market move.

This deeper insight—forecasting the full chain of events from data, to policy, to the true market impact—is invaluable when developing trading strategies.

Next Steps

Once you understand individual currency strength through Intrinsic Analysis, you can:

- Use Cross-Pair Analysis to find optimal trading pairs by combining intrinsic values with market dynamics

- Monitor Market Sentiment to align your trades with broader risk appetite

- Check News Sentiment for real-time developments that may affect your analysis

- Review COT Positioning to see how institutional traders are positioned